In the digital age, the world of banking has undergone a significant transformation. Traditional brick-and-mortar banks are no longer the only option for managing your finances. Fintech innovations have paved the way for a more convenient and efficient banking experience, and one such innovation is the Allo Bank app.

In this comprehensive article, we will delve into the world of Allo Bank, exploring its features, benefits, and the impact it’s making on the banking landscape.

About Allo Bank

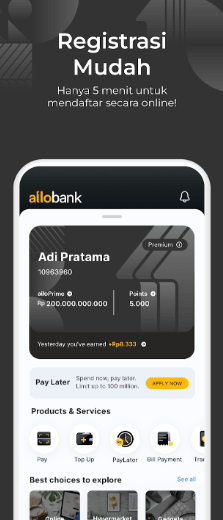

Allo Bank is a trailblazing digital bank that has redefined the way we approach personal and business banking. With a commitment to providing a seamless and user-friendly banking experience, Allo Bank has developed its proprietary mobile application, the Allo Bank Apk. This application represents the bank’s dedication to making banking accessible to everyone, regardless of location or lifestyle.

Don’t Miss: Free fire Mod Apk v1.101.1 Unlimited Diamonds for Android 2023

The Vision

The vision behind Allo Bank is simple yet powerful: to bring banking into the palms of your hands, offering an all-inclusive and hassle-free banking experience. With the Allo Bank Apk, users can access a wide range of banking services with a few taps on their mobile devices, eliminating the need to visit physical bank branches or endure long wait times.

Accessibility

One of Allo Bank’s key differentiators is its accessibility. The Allo Bank Apk is designed to cater to a global audience, providing banking services to people in remote areas, underserved communities, and anyone with a smartphone and an internet connection. This inclusivity is a testament to Allo Bank’s commitment to financial empowerment for all.

Security

Security is a top priority at Allo Bank. The Apk is equipped with robust security features to ensure that your financial information remains safe and confidential. The app employs advanced encryption protocols, biometric authentication, and multi-factor authentication to protect your data and transactions.

Features of Allo Bank Apk

Now, let’s explore the standout features of the Allo Bank Apk, which make it a compelling choice for modern banking needs.

1. Account Management

With the Allo Bank Premium, you can easily open, manage, and monitor your bank accounts from anywhere. Whether you need a savings account, a checking account, or a business account, Allo Bank offers a hassle-free account setup process and real-time account management.

2. Mobile Payments

The Allo Bank app facilitates seamless mobile payments. You can transfer money to friends and family, pay bills, or make online purchases directly from the app. The integration with popular payment gateways and digital wallets ensures a wide range of options for making transactions.

3. ATM Locator

Finding the nearest ATM is a breeze with Allo Bank. The app features an ATM locator that helps you locate the nearest cash machine, reducing the hassle of searching for ATMs when you need cash on the go.

4. Customer Support

Allo Bank’s customer support is easily accessible through the Allo Bank Apk. You can initiate live chats, request assistance, and get answers to your queries without the need to visit a physical branch. This round-the-clock support adds a layer of convenience for users.

5. Budgeting Tools

Managing your finances is made easier with Allo Bank’s budgeting tools. The app provides insights into your spending habits, categorizes expenses, and generates financial reports, helping you make informed decisions about your money.

6. Investment Opportunities

For those looking to grow their wealth, Allo Bank offers investment opportunities through the app. You can explore various investment options, track your portfolio, and make informed investment decisions, all from the comfort of your smartphone.

7. Credit Services

Allo Bank also offers credit services, including loans, credit cards, and more. You can apply for credit products directly from the app, making the entire process convenient and efficient.

8. Currency Exchange

For travelers or international businesses, Allo Bank provides currency exchange services with competitive rates. The app allows you to exchange currencies, view real-time exchange rates, and manage your foreign exchange needs effortlessly.

9. Notifications and Alerts

Stay informed about your account activity with real-time notifications and alerts. Allo Bank ensures that you are aware of any significant transactions, account changes, or security updates.

10. Security Features

As mentioned earlier, security is a paramount concern for Allo Bank. The Allo Bank Apk is equipped with advanced security features, such as biometric authentication, ensuring the utmost protection for your financial information.

Account Management

Account management in Allo Bank refers to the suite of features and services provided by the Allo Bank Apk that enables customers to efficiently oversee and control their bank accounts. This functionality encompasses various actions and tools that simplify the management of financial transactions, account settings, and monitoring of account activities. Here’s a more detailed explanation of the account management features within the Allo Bank Apk:

Account Opening: Allo Bank allows customers to open various types of bank accounts, including savings, checking, and business accounts, directly through the mobile application. The account opening process is streamlined and user-friendly, eliminating the need for in-person visits to a bank branch.

Real-Time Balance Inquiry: Customers can easily check the balance of their accounts in real-time. This feature provides an up-to-the-minute snapshot of their financial status, enabling better financial planning and decision-making.

Transaction History: The Allo Bank Apk maintains a comprehensive transaction history for each account. Users can access and review past transactions, providing transparency and record-keeping capabilities.

Funds Transfer: Account management includes the ability to transfer funds between different accounts. Customers can move money between their savings, checking, or business accounts within the Allo Bank system or make external transfers to other banks.

Bill Payments: Allo Bank simplifies bill payments by allowing customers to pay bills directly through the app. This feature often includes the option to set up recurring payments, ensuring that essential bills are paid on time.

Account Customization: Customers can customize their account settings, such as setting up automatic transfers, creating savings goals, and establishing account nicknames for easier identification.

Statement Access: Electronic account statements are accessible within the Allo Bank. These statements can be viewed, downloaded, and saved for record-keeping purposes.

Alerts and Notifications: Allo Bank provides customizable alerts and notifications for various account activities. Users can set up alerts for low balances, large transactions, and other account-specific events to stay informed about their financial activity.

Debit and Credit Card Management: Customers can manage their debit and credit cards through the app, including activities like card activation, blocking, setting spending limits, and transaction monitoring.

Account Closure: The application typically allows customers to request account closures if they decide to no longer use a specific account. This process is usually straightforward and can be initiated through the app.

Direct Deposits: Allo Bank customers can set up direct deposits for their salaries, pensions, or other sources of income, ensuring that funds are automatically credited to their accounts.

Account Information Updates: Users can update personal information, such as contact details and mailing addresses, through the app, ensuring that the bank has accurate and up-to-date information.

In summary, account management in Allo Bank streamlines the way customers interact with their bank accounts, providing a range of convenient and user-friendly features to help individuals and businesses manage their finances effectively. This level of control and accessibility is a significant advantage of digital banks like Allo Bank, offering a seamless and secure banking experience right at the users’ fingertips.

Download The Allo Bank PRO MOD APK

How To Install Allo Bank MOD APK For Android & iOS

Installing the mod on your Android or iOS device is slightly different than installing the regular app. Here’s a step-by-step guide to help you get started:

For Android:

- Go to your phone’s Settings and then click on Security.

- Enable the “Unknown Sources” option to allow installations from third-party sources.

- Download the Allo Bank Pro APK from a reliable source.

- Once the download is complete, open the APK file.

- Click on “Install” and wait for the installation process to finish.

Once the installation is complete, open the app and log in to your account.

For iOS:

- Install a third-party app installer like TutuApp or TweakBox on your iPhone or iPad.

- Open the app installer and search for “Allo Bank MOD APK”.

- Select the app from the search results.

- Click on “Get” and then “Install” to start the installation process.

Once the installation is complete, open the MOD app and log in to your account.

FAQs

Q: Apa itu Allo Bank Indonesia?

A: Allo Bank Indonesia adalah bank digital yang beroperasi di Indonesia. Mereka menyediakan berbagai layanan perbankan secara online, termasuk pembukaan rekening, transfer dana, pembayaran tagihan, dan banyak lagi melalui aplikasi perbankan mereka.

Q: Apa yang dimaksud dengan Allo Bank Festival 2023?

A: Allo Bank Festival 2023 adalah sebuah acara atau program yang diselenggarakan oleh Allo Bank Indonesia. Rincian lebih lanjut tentang acara ini mungkin tergantung pada informasi terbaru, tetapi biasanya ini adalah ajang promosi atau perayaan yang dapat mencakup penawaran khusus, hadiah, atau kegiatan lain yang melibatkan pelanggan bank.

Q: Apakah Allo Bank Indonesia memiliki cabang fisik?

A: Allo Bank Indonesia adalah bank digital, sehingga tidak memiliki cabang fisik seperti bank konvensional. Semua layanan mereka tersedia secara online melalui aplikasi perbankan mereka. Anda dapat mengakses rekening dan melakukan transaksi melalui perangkat seluler atau komputer.

Conclusion

In conclusion, the Allo Bank represents a pivotal advancement in the world of banking. With its commitment to accessibility, user-friendliness, and security, Allo Bank is on a mission to redefine the way we manage our finances. The Allo Bank APK’s diverse range of features, from account management to investment opportunities, cater to the diverse needs of individuals and businesses alike.

As the digital banking landscape continues to evolve, Allo Bank stands out as a beacon of innovation, providing a reliable and convenient solution for all your banking needs. The Allo Bank Apk empowers users to take control of their finances, offering a comprehensive and user-friendly platform for banking services, right at your fingertips.

In a world where convenience, accessibility, and security are of utmost importance, the Allo Bank Apk is a game-changer, ushering in a new era of digital banking that is both empowering and accessible to all. Whether you’re managing your personal finances, running a business, or planning your financial future, Allo Bank has your back, and it’s all in the palm of your hand. Make the switch to Allo Bank and experience the future of banking today.