In an era where convenience and customization are paramount, the banking industry is no exception. Traditional brick-and-mortar banks are being replaced by digital banking solutions that offer an array of features and benefits to their customers. One such innovative offering is the Allo Bank Premium account, designed to provide a comprehensive and premium banking experience to its users.

In this in-depth review, we’ll explore what Allo Bank Premium is all about, its key features, and why it might be the ideal choice for those looking to elevate their banking experience.

About Allo Bank Premium APK

Allo Bank Premium is not just another banking option; it’s a tailored financial solution that combines the ease of modern digital banking with a range of premium services and features. It’s more than just a bank account; it’s a gateway to a sophisticated, hassle-free financial life.

Whether you’re an individual looking for top-notch personal banking services or a business owner seeking a reliable partner for your financial needs, Allo Bank Premium has something to offer everyone.

Don’t Miss: Alliance Shield X Apk v0.9.07 Free Download

Key Features of Allo Bank Premium APK

Let’s dive into the standout features that make Allo Bank Premium a compelling choice for discerning individuals and businesses alike.

1. Personalized Customer Support

One of the cornerstones of Allo Bank Premium is its commitment to delivering exceptional customer service. Account holders can access a dedicated relationship manager who is available to assist with any queries or concerns. This personalized approach ensures that your financial needs are understood and addressed effectively.

2. Enhanced Security

Security is paramount when it comes to your finances, and Allo Bank Premium understands that. It offers state-of-the-art security features to protect your accounts and transactions. You can rest easy knowing that your financial data is in safe hands.

3. Exclusive Discounts and Offers

Allo Bank Premium members gain access to a wide range of exclusive discounts and offers from partner businesses. Whether it’s discounts on travel, shopping, or dining, you’ll enjoy significant savings that can make a substantial difference in your overall expenses.

4. High-Yield Savings Account

If you’re looking to grow your wealth, Allo Bank Premium provides an attractive interest rate on its savings accounts. Your money won’t just sit there; it will work for you, earning you more with every passing day.

5. Zero ATM Fees Worldwide

Say goodbye to those pesky ATM fees. With Allo Bank Premium, you can withdraw your money from ATMs around the world without incurring any fees. This is a game-changer for frequent travelers and international businesspeople.

6. Concierge Services

Imagine having a personal assistant at your fingertips. Allo Bank Premium offers concierge services to help you with various tasks, from booking travel accommodations to organizing events. This is a fantastic benefit that can save you both time and effort.

7. Investment Opportunities

For those who want to take their finances to the next level, Allo Bank Premium offers investment opportunities that align with your financial goals and risk tolerance. You’ll have access to a wide range of investment options and expert guidance to help you make informed decisions.

8. Customized Credit Solutions

Whether you need a personal loan, a business line of credit, or a mortgage, Allo Bank Premium provides customized credit solutions tailored to your specific needs. This flexibility ensures that you can access the funds you require on terms that suit you best.

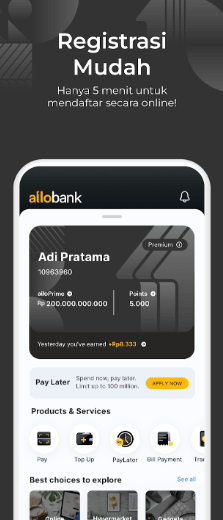

9. Mobile Banking App

Stay in control of your finances wherever you are with the Allo Bank Premium mobile app. It’s user-friendly, secure, and packed with features that enable you to manage your accounts, make payments, and track your investments on the go.

10. Transparency and Convenience

With Allo Bank Premium, you’ll receive regular statements and alerts to keep you informed about your account activity. The user-friendly online platform ensures you can manage your finances with ease, making your banking experience both transparent and convenient.

Personalized Customer Support

The personalized customer support offered by Allo Bank Premium is a standout feature designed to enhance the overall banking experience for its account holders. This service goes beyond the standard customer support you might receive at a traditional bank, offering a more tailored and attentive approach. Here’s what you can expect from the personalized customer support of Allo Bank Premium:

- Dedicated Relationship Manager: When you become an Allo Bank Premium member, you are assigned a dedicated relationship manager. This individual is your main point of contact within the bank. They are responsible for understanding your unique financial needs, preferences, and goals.

- Tailored Assistance: Your relationship manager is there to provide you with personalized assistance. Whether you have questions about your accounts, need help with transactions, or require financial advice, your relationship manager is just a call or message away. They have an in-depth understanding of your financial situation, which allows them to offer tailored solutions and recommendations.

- Proactive Communication: Allo Bank Premium’s relationship managers are proactive in reaching out to you. They keep you informed about relevant updates, new services, and special offers that match your financial profile and needs. This proactive communication ensures you don’t miss out on valuable opportunities.

- Financial Planning: If you’re interested in financial planning, your relationship manager can work with you to create a personalized financial plan. This plan may include savings goals, investment strategies, and ways to optimize your finances. They are well-equipped to guide you toward achieving your financial objectives.

- Problem Resolution: Should you encounter any issues or concerns related to your banking experience, your dedicated relationship manager is there to help you navigate and resolve these problems promptly. This personalized support can save you time and reduce the stress often associated with financial issues.

- Accessibility: You can reach out to your relationship manager through various communication channels, such as phone, email, or secure messaging within the bank’s mobile app or online platform. This accessibility ensures that you can get the help you need whenever it’s most convenient for you.

In summary, Allo Bank Premium’s personalized customer support aims to provide a high level of service that understands your specific financial circumstances and requirements. Having a dedicated relationship manager at your disposal makes it easier to navigate the complexities of modern banking, and it ensures that your banking experience is as smooth and tailored as possible.

This level of personalized support is one of the key reasons many individuals and businesses choose Allo Bank Premium for their banking needs.

Download The Allo Bank PRO MOD APK

How To Install Allo Bank MOD APK For Android & iOS

Installing the mod on your Android or iOS device is slightly different than installing the regular app. Here’s a step-by-step guide to help you get started:

For Android:

- Go to your phone’s Settings and then click on Security.

- Enable the “Unknown Sources” option to allow installations from third-party sources.

- Download the Allo Bank Pro APK from a reliable source.

- Once the download is complete, open the APK file.

- Click on “Install” and wait for the installation process to finish.

Once the installation is complete, open the app and log in to your account.

For iOS:

- Install a third-party app installer like TutuApp or TweakBox on your iPhone or iPad.

- Open the app installer and search for “Allo Bank MOD APK”.

- Select the app from the search results.

- Click on “Get” and then “Install” to start the installation process.

Once the installation is complete, open the MOD app and log in to your account.

FAQs

Q1: What is Allo Bank Pre?

A1: Allo Bank Pre is not a well-known banking product or service as of my last knowledge update in September 2021. It’s possible that it could be a new offering introduced after that date or a regional/local bank-specific product. To get accurate information, I recommend contacting the bank directly or visiting their official website.

Q2: What is Allo Bank Premium?

A2: Allo Bank Premium is a premium banking service or account offered by a financial institution. The specific features and benefits of an Allo Bank Premium account may vary depending on the bank providing it. Generally, premium accounts offer perks like higher interest rates, reduced fees, exclusive access to certain services, and personalized customer support. To get detailed information about Allo Bank Premium, it’s advisable to contact the bank offering this service.

Q3: How can I upgrade to Allo Bank Premium?

A3: The process for upgrading to Allo Bank Premium may vary depending on the bank’s policies and procedures. To upgrade to a premium account, you should typically:

- Contact the Bank: Get in touch with your bank’s customer service or visit a local branch. They will guide you through the specific steps.

- Review Eligibility: Ensure that you meet the eligibility criteria for the premium account. This may include maintaining a minimum balance or meeting certain income requirements.

- Submit Necessary Documents: Prepare the required documents, such as proof of identity, address, and income.

- Pay Any Associated Fees: Some premium accounts may have fees or minimum balance requirements. Be prepared to pay these fees, if applicable.

- Complete the Application: Fill out the necessary forms or applications provided by the bank.

- Wait for Approval: Your bank will review your application and, if you meet the criteria, you’ll be upgraded to the Allo Bank Premium account.

Q4: What is the limit on the Allied Bank Student Account?

A4: The specific limit on an Allied Bank Student Account can vary depending on the type of account and the bank’s policies. Student accounts are typically designed to offer specific benefits to students, such as lower fees or minimum balance requirements. To find out the exact limit or any restrictions on an Allied Bank Student Account, it’s best to contact the bank directly or visit their official website. They will provide you with the most up-to-date information on their student account offerings.

Conclusion

In conclusion, Allo Bank Premium is not just a bank; it’s a financial partner that’s dedicated to helping you achieve your financial goals. With its personalized customer support, enhanced security, and a host of premium features, it caters to the diverse needs of individuals and businesses alike. Exclusive discounts, high-yield savings accounts, zero ATM fees worldwide, and investment opportunities are just a few of the many benefits that set Allo Bank Premium apart.

The concierge services and customized credit solutions make it a one-stop solution for all your financial needs, while the mobile banking app ensures that you have access to your accounts and investments no matter where you are. Allo Bank Premium aims to make banking not just hassle-free but also rewarding, providing its account holders with an exclusive banking experience that’s worth its weight in gold.

If you’re seeking a banking experience that goes beyond the ordinary, consider Allo Bank Premium. It’s the key to unlocking a world of financial possibilities, and it may be the partner you’ve been searching for to elevate your banking experience to new heights. Embrace the future of banking with Allo Bank Premium, and watch your financial dreams become a reality.